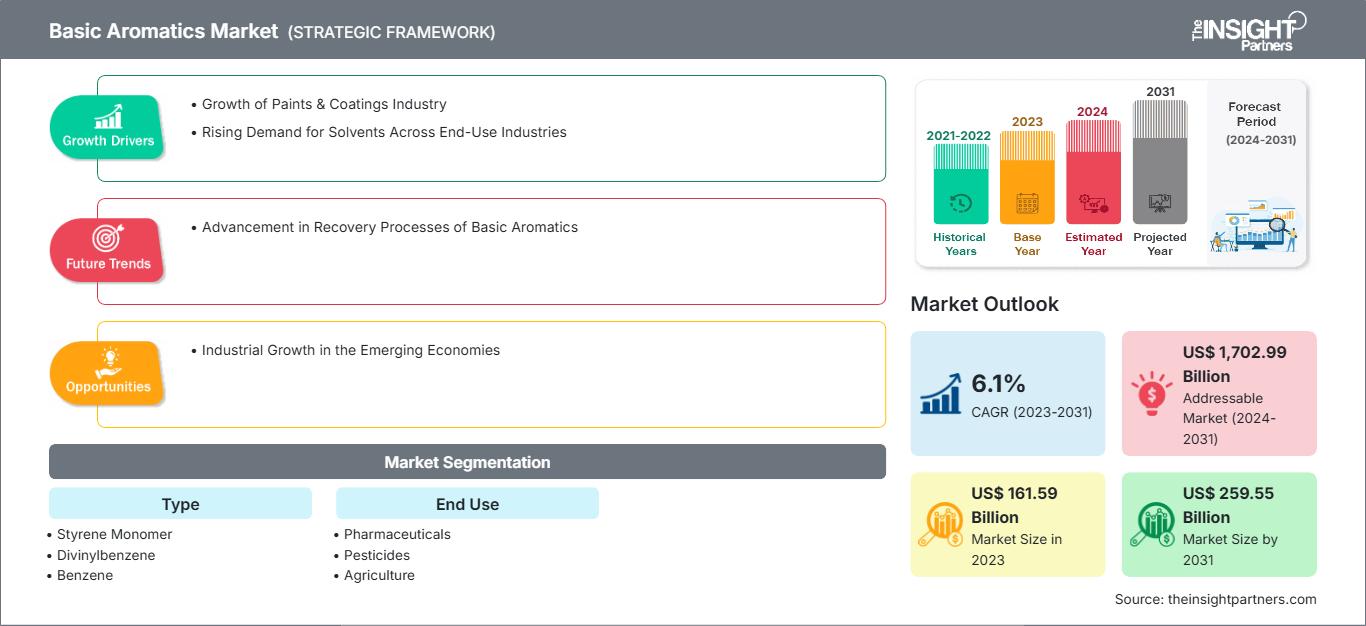

United States of America– 24 Dec 2025- The basic aromatics market size is projected to reach US$ 259.55 billion by 2031 from US$ 161.59 billion in 2023. The market is expected to register a CAGR of 6.1% during 2023–2031. The advancement in recovery processes of basic aromatics with techniques such as continuous catalytic reforming has improved yield and stability, which is likely to bring new trends into the basic aromatics market.

Basic aromatics, including benzene, toluene, xylene, cresol, and pyridine, serve as foundational building blocks in numerous industries, driving consistent market momentum through versatile applications. These cyclic hydrocarbons with benzene rings underpin production in solvents, paints, pharmaceuticals, and beyond, fueled by advancements in recovery processes like continuous catalytic reforming that enhance yield and stability.

Market Drivers

Rising demand for solvents across end-use sectors propels the basic aromatics landscape, as their solubility properties make them ideal for dissolving organic compounds in paints, coatings, adhesives, and printing inks. Toluene excels in gravure printing inks for fast-drying traits, while mixed xylenes support cleaning in electronics and polymerization for synthetic rubber like styrene-butadiene variants. Industrial growth in emerging economies, particularly Asia Pacific, amplifies this trend, with expanding manufacturing in plastics, textiles, rubber, and chemicals drawing foreign investment through supportive policies.

The paints and coatings sector further accelerates adoption, leveraging benzene as a precursor for styrene-based resins that boost corrosion resistance, adhesion, and aesthetics in construction, automotive, and furniture applications. Benzene also aids pharmaceutical synthesis, pesticide production, and lubricants, while xylene dominates feedstock roles in construction chemicals.

Download PDF Copy- https://www.theinsightpartners.com/sample/TIPRE00009937

Key Applications

Solvents lead end-use segments, dominating due to widespread utility in chemical manufacturing, rubber processing, and leather industries, where high-purity variants ensure precision in electronic components. Paints and coatings follow closely, incorporating aromatics for enhanced surface properties amid booming infrastructure projects worldwide.

Pharmaceuticals rely on benzene for drug synthesis, alongside pesticides and agriculture where benzene and xylene enable effective formulations. Emerging roles span cosmetics, food and beverages, and personal care, with bio-based alternatives gaining traction for natural scents and sustainable polymers. Xylene holds prominence among types, supporting synthetic fibers like polyester and resins such as polyethylene terephthalate.

Regional Insights

Asia Pacific commands the forefront, propelled by pharmaceutical production leadership and rapid industrialization in countries like India, attracting investments in textiles, chemicals, and paints. Government initiatives targeting manufacturing GDP contributions foster this dominance, outpacing North America and Europe where established chemical hubs focus on innovation.

Emerging economies benefit from cost-effective feedstocks like shale gas, boosting automotive and construction sectors that demand robust aromatics supply chains. Middle East & Africa and South & Central America show potential through infrastructure pushes, though Asia Pacific's CAGR lead underscores its pivotal role.

Industry Trends

Sustainability emerges as a transformative force, with bio-based aromatics from biomass and plastic waste challenging traditional petroleum routes via lignin valorization and renewable pathways. Investments in technologies like BioBTX's ICCP for sustainable BTX production signal a shift toward circular economy models, reducing carbon footprints in polymers and resins.

Digitalization and AI-driven optimization streamline production, enhancing efficiency in aromatic chemical flows amid consumer preferences for eco-friendly products. Recovery process innovations, including catalytic reforming, improve output stability, aligning with regulatory pressures for greener solvents in packaging and personal care.

Leading Players

Major contributors include The Dow Chemical Co., Exxon Mobil Corp., BASF SE, Shell Plc, and LyondellBasell Industries NV, alongside Sasol Ltd., Lanxess AG, INEOS Group Holdings SA, and Nippon Steel Corp. These firms expand offerings through acquisitions, like INEOS's aromatics purchase, and R&D in bio-aromatics to meet evolving demands.

Strategic moves emphasize portfolio diversification into high-performance solvents and sustainable variants, capitalizing on end-user shifts in automotive, textiles, and pharmaceuticals.

Future Outlook

The basic aromatics market navigates a dynamic path, balancing solvent versatility with bio-alternatives amid industrial expansion in emerging regions. End-user diversification into fine chemicals and adhesives, coupled with technological leaps, positions stakeholders for resilient growth.

Related Reports-

About Us:

The Insight Partners is a one-stop industry research provider of actionable intelligence. We help our clients get solutions to their research requirements through our syndicated and consulting research services. We specialize in semiconductor and electronics, aerospace and defense, automotive and transportation, biotechnology, healthcare IT, manufacturing and construction, medical devices, technology, media and telecommunications, and chemicals and materials.

Contact Us:

If you have any queries about this report or if you would like further information, please get in touch with us:

Contact Person: Ankit Mathur

E-mail: ankit.mathur@theinsightpartners.com

Phone: +1-646-491-9876

Also Available in : Korean| German| Japanese| French| Chinese| Italian| Spanish