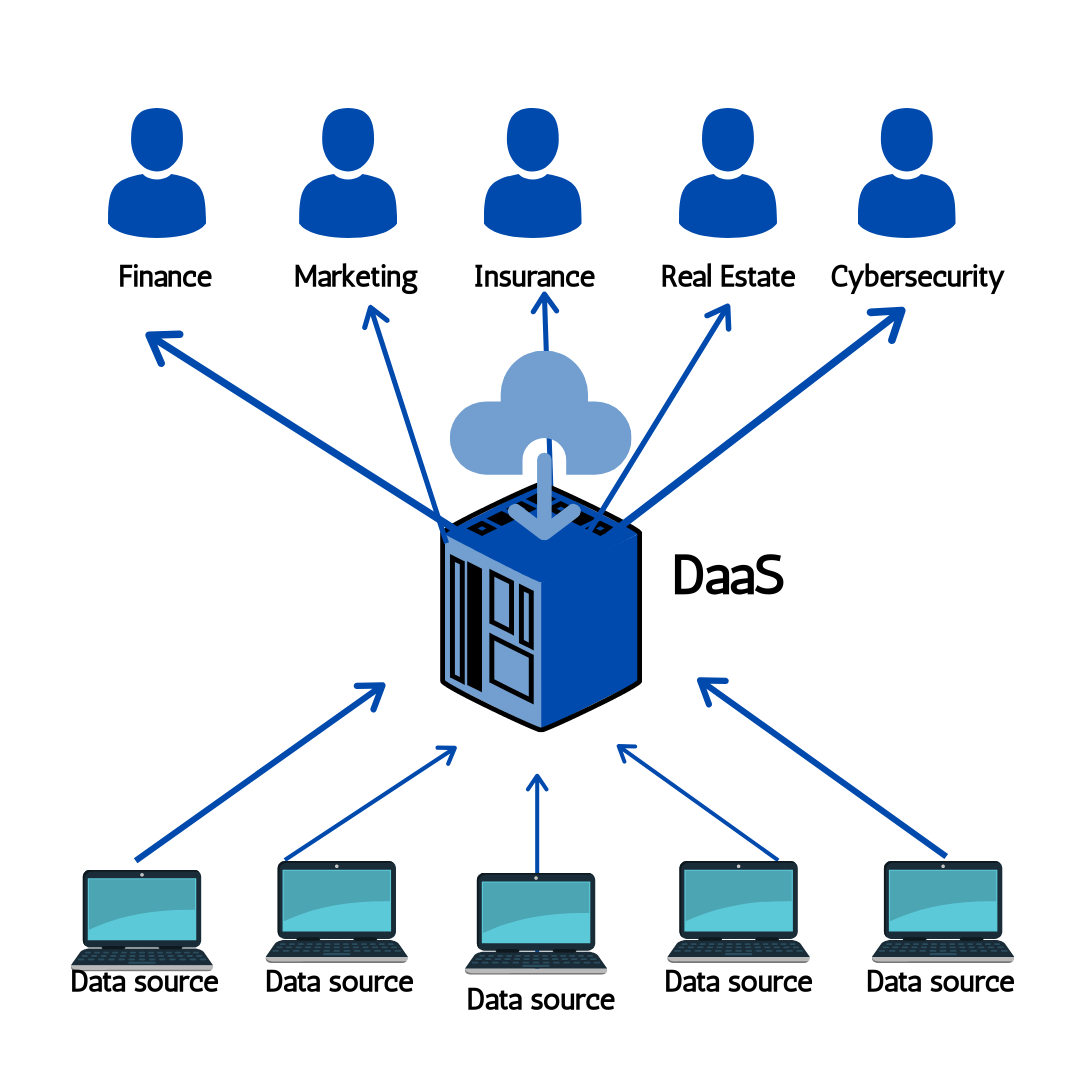

For any entrepreneur or new company seeking to enter the high-stakes world of Data as a Service (DaaS), a well-defined and strategically focused approach is absolutely essential. The formulation of effective Data as a Service (DaaS) Industry Entry Strategies must begin with a clear recognition of the industry's primary barrier to entry: the difficulty of acquiring a unique, valuable, and defensible dataset. A new company cannot simply decide to compete with Dun & Bradstreet on business data or Bloomberg on financial data; these incumbents have built their data moats over decades. Therefore, a successful entry must be based on a strategy of "data arbitrage"—finding a source of data that is currently undervalued, inaccessible, or difficult to use, and then building a business around making that data valuable, accessible, and easy to consume. The key is not to compete with the existing data giants on their own turf, but to find a new, unexploited "data oil well" and become the sole supplier of that resource.

One of the most powerful and proven entry strategies is to focus on creating a novel alternative dataset. This involves identifying a source of raw, unstructured information that contains a predictive signal and then building the technology to transform that raw information into a clean, structured data product. For example, a startup could develop a system that uses computer vision to analyze live video feeds from traffic cameras in major cities to create a real-time index of urban economic activity. Another could use natural language processing (NLP) to analyze the text of thousands of pending patents to identify emerging technological trends. The key to this strategy is that the raw data source is often publicly available or obtainable, but the process of turning it into a valuable, analytical-ready dataset is a difficult data science and engineering challenge. By solving this challenge, the new company creates a unique data asset that it can then license to financial firms and corporations. The competitive advantage is not ownership of the raw data, but the intellectual property of the transformation process.

Another effective entry strategy is the "picks and shovels" model, which involves building a tool or service that helps other companies work with data more effectively. Instead of selling data itself, the new company sells a technology that makes data more valuable. For example, a startup could build a best-in-class data quality and preparation platform that uses AI to automatically clean, de-duplicate, and enrich messy datasets. It could then sell this software to both data providers (to help them improve the quality of their products) and data consumers (to help them prepare their internal data for analysis). Another example is to build a platform for data discovery, helping large enterprises to catalog and understand the vast amounts of data they already own but that is often siloed and inaccessible. By focusing on solving a critical pain point in the data workflow, a new entrant can build a highly valuable business without ever having to own a single proprietary dataset. This approach allows the company to serve the entire DaaS ecosystem, rather than competing within it. The Data as a Service (DaaS) Market size is projected to grow to USD 75.2 Billion by 2035, exhibiting a CAGR of 17.23% during the forecast period 2025-2035.

Top Trending Reports -

Brazil Edge Data Center Market