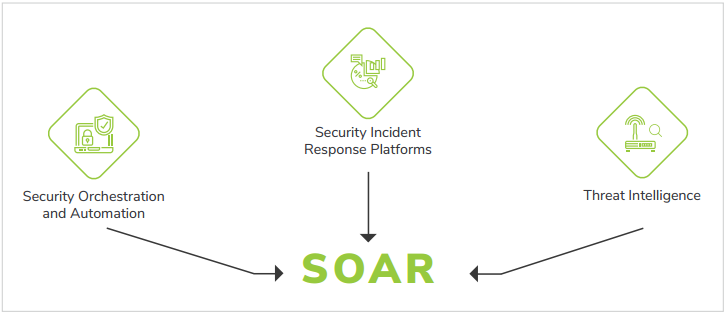

The global market for Security Orchestration, Automation, and Response (SOAR) has undergone one of the fastest and most decisive periods of consolidation of any recent cybersecurity market segment. A focused examination of Security Orchestration Automation and Response Market Share Consolidation reveals a landscape where the once-vibrant field of independent, pure-play SOAR startups has been almost entirely absorbed by the major security platform giants. This rapid consolidation is a direct result of a "perfect storm" of factors: a wave of strategic acquisitions by the major SIEM and security platform vendors, the immense technical value of integrating SOAR directly into a broader SecOps workflow, and the customer's strong preference for a single, unified platform. As SOAR has proven its value, it has transitioned from a standalone, best-of-breed market into an essential, table-stakes feature of a larger platform. The Security Orchestration Automation and Response Market size is projected to grow USD 8.27 Billion by 2035, exhibiting a CAGR of 10.52% during the forecast period 2025-2035. This growth is now almost entirely being captured by the major platforms, solidifying a highly consolidated market structure.

The primary and most direct mechanism for this consolidation has been a series of major acquisitions that saw nearly all of the leading independent SOAR pioneers being bought by the major platform players. This happened with incredible speed. Splunk, the leader in SIEM, acquired Phantom. Palo Alto Networks, a leader in network security, acquired Demisto. Google, a major cloud and security player, acquired Siemplify. IBM acquired Resilient. These were not small "tuck-in" deals; they were major, landscape-altering acquisitions of the market's leading and most innovative companies. This M&A frenzy was driven by the strategic realization among the platform giants that SOAR was a critical missing piece of their security operations story. By acquiring these companies, they instantly gained a best-in-class SOAR capability, a team of experienced engineers, and a roster of enterprise customers, while simultaneously eliminating a potential competitor or a company that a rival might acquire. This wave of acquisitions in a very short period of time effectively and directly consolidated the market.

This M&A-driven consolidation has been powerfully reinforced by the demand-side pull from customers for integrated solutions. In the modern, overwhelmed Security Operations Center (SOC), the last thing a CISO wants is another standalone console to manage. The value proposition of having a SOAR capability that is natively integrated into the SIEM or XDR platform that their team already uses every day is incredibly compelling. It promises a more seamless workflow, better data correlation, and simplified vendor management. This has made it very difficult for the few remaining independent SOAR vendors to compete. They are forced to sell to customers who are already being heavily marketed to by their existing SIEM or security platform vendor, who can often bundle the SOAR functionality in at a very attractive price point. This "good enough" and deeply integrated offering from the major platforms creates a massive competitive disadvantage for the standalone players. The end result is a market that has moved in just a few short years from a fragmented, innovative startup space to a highly consolidated feature of a few dominant security platforms.

Top Trending Reports -

Germany Photogrammetry Software Market